37+ Annual Depreciation Calculator

Straight Line Depreciation Formula. C is the original purchase price or basis of an.

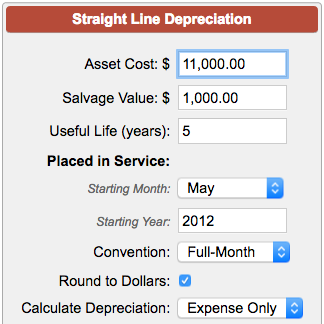

Straight Line Depreciation Calculator

For those who may be new to the field of accounting and finance we will also cover.

. The calculator uses the following formulae. Fact checked by Melody Kazel. Where Di is the depreciation in year i.

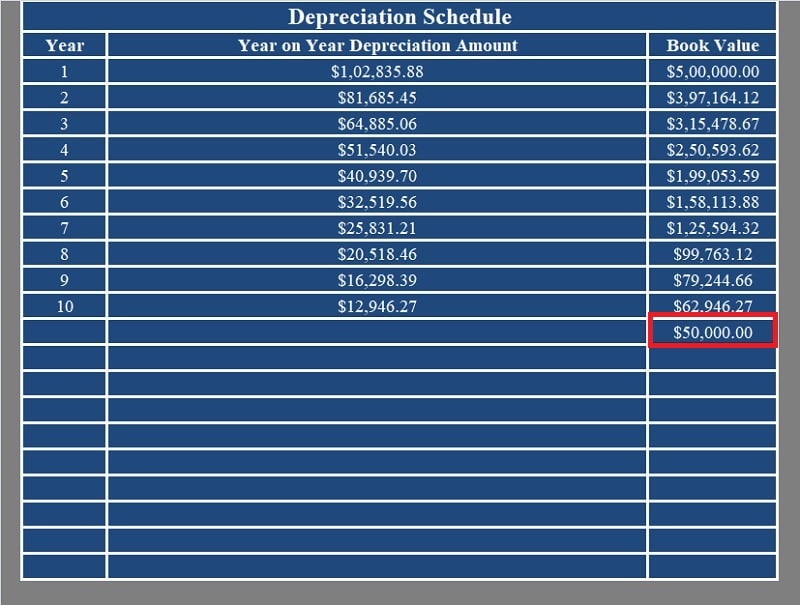

Depreciation is handled differently for. Web Heres a simplified formula. Web This depreciation calculator shows your car depreciation schedule year by year including Beginning Book Value Depreciation Percent Depreciation Amount Accumulated.

Depreciation Amount Asset Value x Annual Percentage. 35000 - 10000 5 5000. Web The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life.

Web Depreciation is an annual income tax deduction that allows you to recover the cost or other basis of certain property over the time you use the property. 100 Bonus Depreciation Ends December 31 2022. Web This calculator will help you find the total depreciated value in real-time.

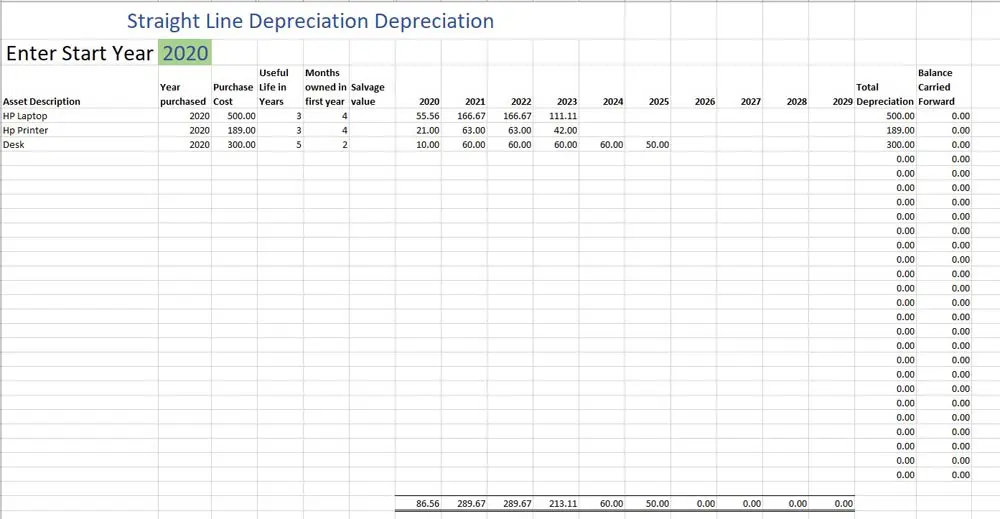

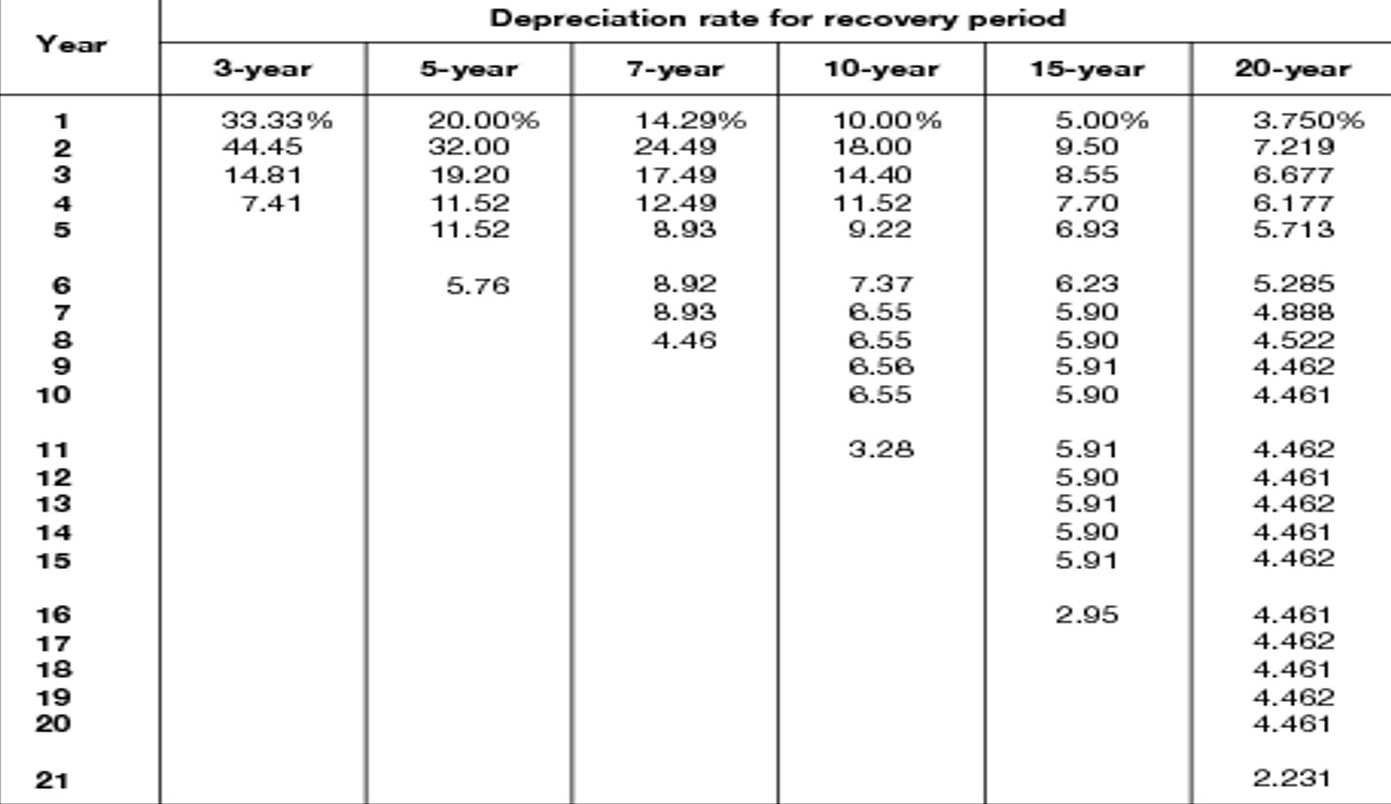

D i C R i. Web Here are four primary ways of calculating depreciation. Web 11 rows This calculator is designed to work out the depreciation of an asset over a specified number of years using either the Straight Line or Reducing Balance Methods.

Web Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of. You may also be. Web By using the formula for the straight-line method the annual depreciation is calculated as.

This is the most common method and is used to split the value of an asset. What happens after 275 years of depreciation. 100 Bonus Depreciation Ends December 31 2022.

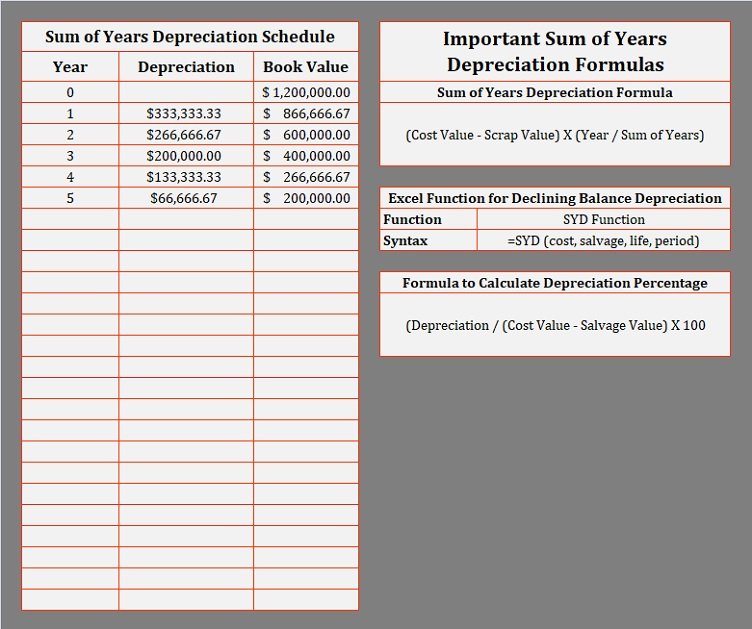

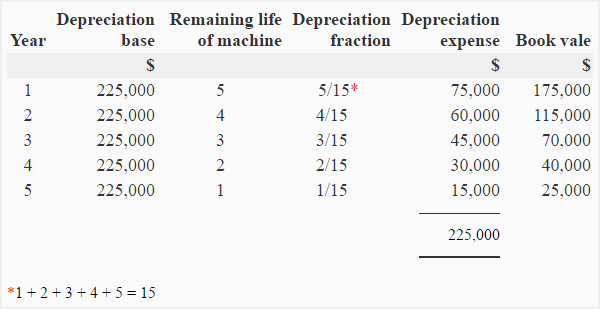

Web The four methods for calculating depreciation allowable under GAAP include straight-line declining balance sum-of-the-years digits and units of production. Web The MACRS Depreciation Calculator uses the following basic formula. It is an allowance for the.

Web Calculate depreciation compare methods and print schedules for the most common depreciation methods including straight line double declining balance sum of. 1st Year Depreciation Expense. Ad Let us help you maximize your Real Estate cash flow on commercial property.

This means the van depreciates at a rate. Web Updated March 19 2023. Balance Asset Value - Depreciation Value.

The term depreciation refers to an accounting. Depreciation Expense Purchase Price Land Value Depreciation Period. Final Year Depreciation Expense.

Ad Let us help you maximize your Real Estate cash flow on commercial property.

Solved Calculate Free Cash Flow For 2014 For Monarch Textiles Assume All 1 Answer Transtutors

View Monthly Detail For Fixed Asset Depreciation Calculation Depreciation Guru

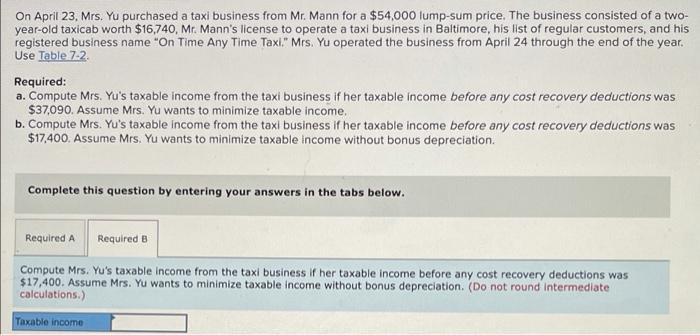

Solved On April 23 Mrs Yu Purchased A Taxi Business From Mr Mann For A 1 Answer Transtutors

Car Depreciation Calculator

Depreciation Calculator

Free Depreciation Calculator Online 2 Free Calculations

Car Depreciation Calculator

Solved Depreciation Rate For Recovery Period Year 3 Year Chegg Com

Depreciation Calculator Depreciation Guru

Finalinvestormeetingsapr

Depreciation Calculation For Table And Calculated Methods Oracle Assets Help

4 Ways To Calculate Depreciation On Fixed Assets Wikihow

Sum Of Years Depreciation Calculator Template Msofficegeek

Download Depreciation Calculator Excel Template Exceldatapro

Free Depreciation Calculator Online 2 Free Calculations

Xp Inc Integrated Annual Report 2022 Ex 99 2 June 30 2023

Sum Of Years Digits Method Accounting For Management